Navigating the 2024 Construction Market – A Guide for Homeowners

As we approach 2024, the landscape of home construction presents both unique challenges and exciting opportunities. With fluctuations in interest rates and an evolving construction market, understanding these dynamics is crucial for homeowners planning to build their dream homes. This guide offers insights into the 2024 construction market, the impact of rising interest rates, and what potential home builders can expect in the coming year.

The 2024 Construction Market Overview

The new construction market in 2024 is shaping up to be a landscape of innovation and adaptation. Following a period of economic uncertainty, the market is poised for a rebound with an emphasis on sustainability and energy efficiency. Residential construction is seeing a shift toward more durable materials and smarter home technologies, catering to a growing demand for homes that are both modern and environmentally conscious.

However, these advancements come amidst economic adjustments, notably in financing costs. Higher interest rates are influencing both builders and buyers, affecting everything from project timelines to budgeting decisions. Understanding these factors is key to navigating the market effectively.

Understanding Interest Rates and Their Impact

Interest rates in 2024 have seen a noticeable increase, a trend influenced by broader economic policies aimed at curbing inflation. For homeowners, this means higher borrowing costs, which can significantly impact the overall cost of building a new home. Mortgage rates are climbing, making it crucial for potential builders to lock in rates where possible or explore alternative financing options.

The silver lining? Higher interest rates often cool down overheated markets, potentially decreasing competition for building resources and labor. For those prepared, this could be an opportune time to plan a build, provided the financial groundwork is laid with care.

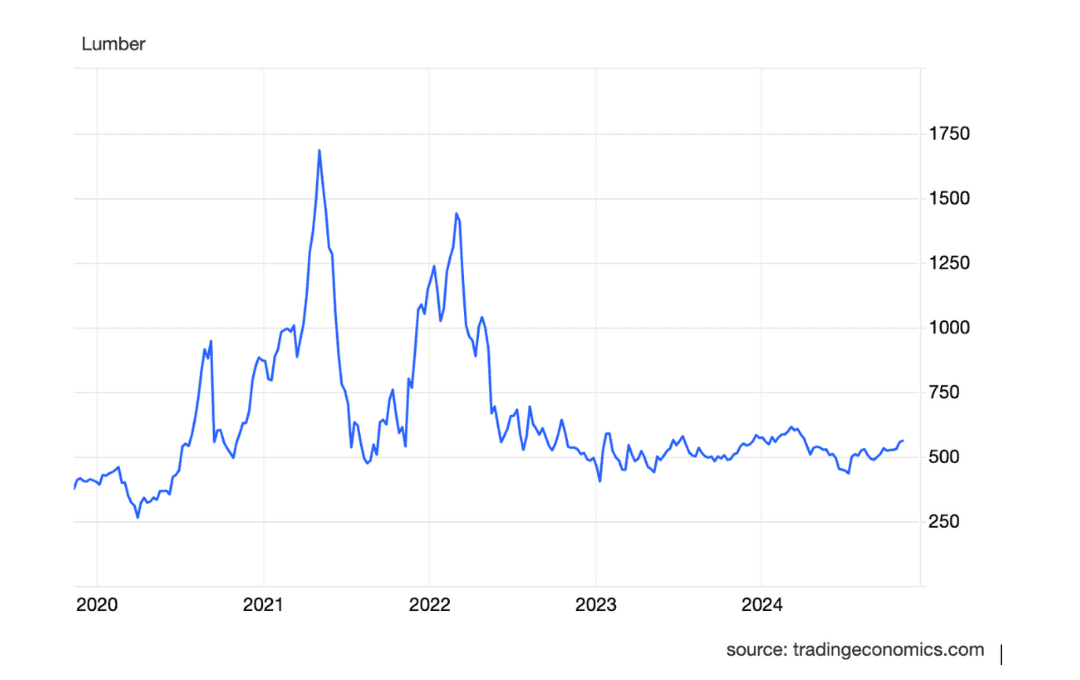

As production in a number of industries have returned to pre-pandemic production levels, so too has the lumber market. From a high of $1,401.30/MBF[1] lumber prices have dropped almost 2/3 to $70.71/MBF as of November 4, 2024. Trading Economics provided the following chart to illustrate the changes in the lumber market [updated November 2024].

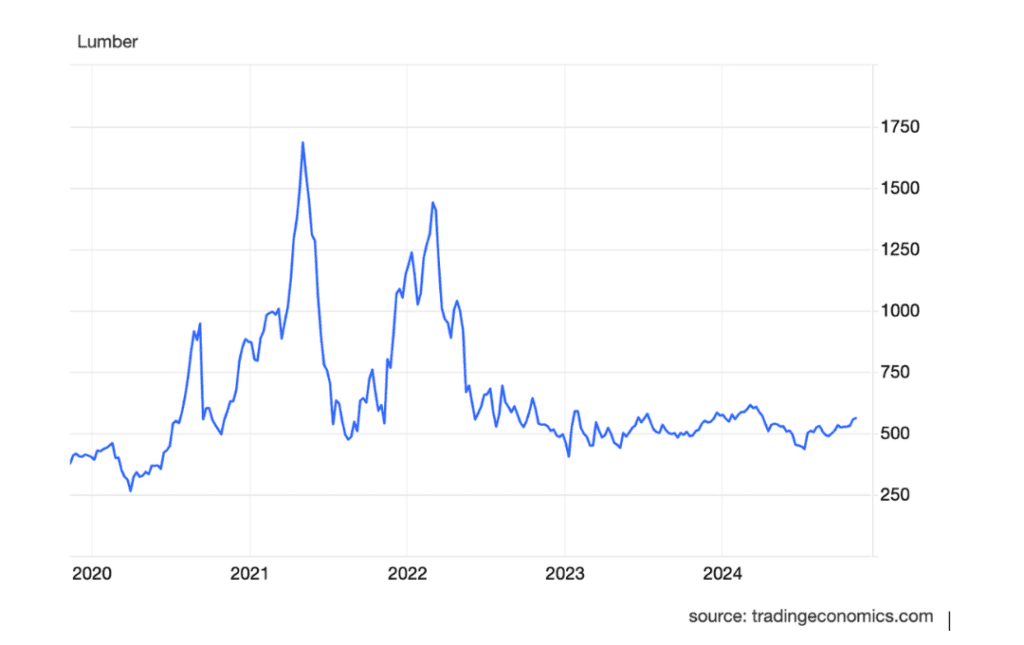

Fastmarkets also predicts a drop in dimensional lumber prices as you can see here.

Fastmarkets predicts lumber production levels will increase to the highest levels since 2005 further driving the price down.

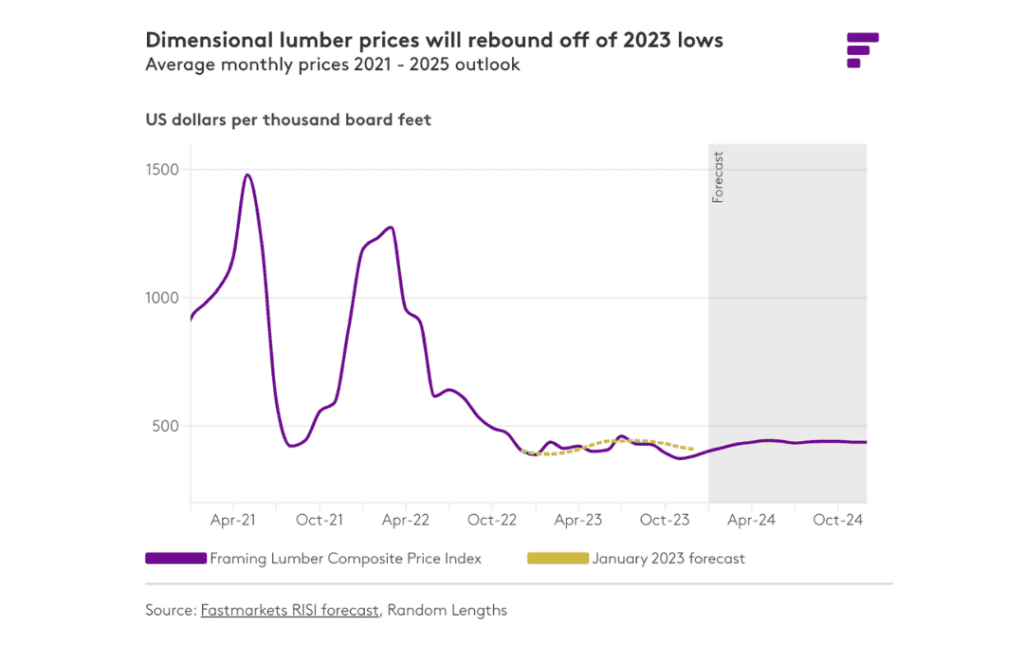

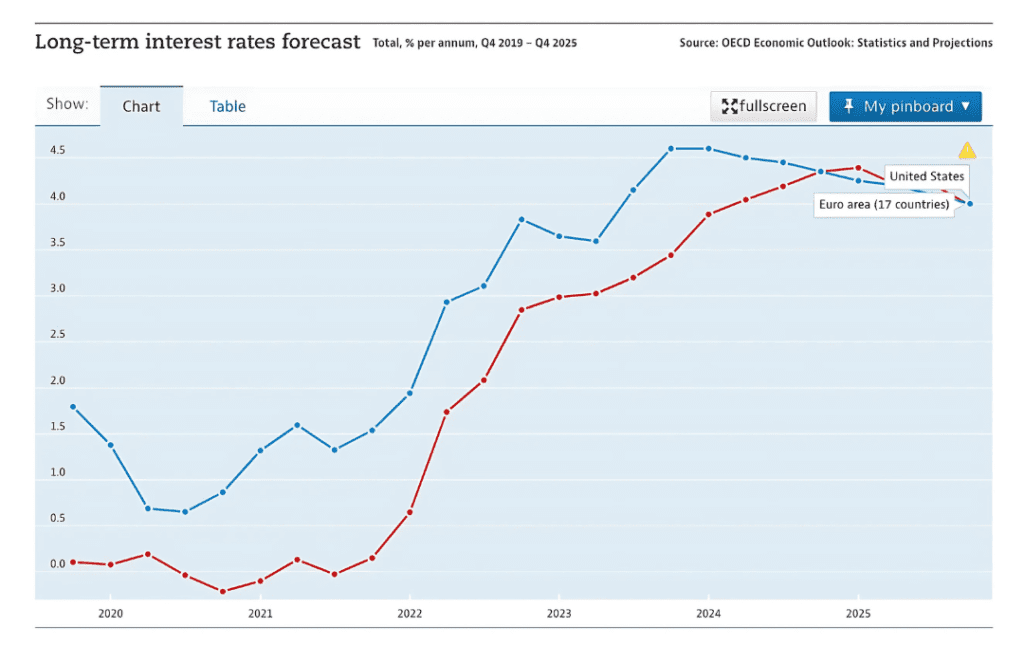

Below, you can see from the OECD (Organisation for Economic Co-operation and Development) Long-term interest rates forecast. This forecast refers to “projected values of government bonds maturing in ten years,” [2]. The OECD has indicated their models show a return to target inflation levels in most countries by the end of 2025. While the Fed has been hesitant to cut rates, inflation is falling faster than expected.

The Mortgage Bankers Association forecasted mortgage rates will fall from Q1 2024’s 6.8% to 6.4% in Q4 while the National Association of Realtors expects mortgage rates to fall to 6.5% in Q4. Both Realtor.com and Wells Fargo have forecasted rates dropping to 6.5% for Q4 2024 as well. Additionally, the National Association of Home Builders released their 10-point plan to address housing affordability this week. You can view that plan here.

What to Expect in New Construction Design

New construction homes in 2024 are designed to adapt to changing environmental and technological landscapes. Expect to see increased use of sustainable materials like bamboo and recycled steel, and technologies such as solar tiles and smart home systems that promote energy efficiency.

Design-wise, more homeowners are opting for flexible living spaces. The rise of remote work continues to influence home layouts, with dedicated office spaces becoming a standard feature. Additionally, outdoor living areas are being emphasized, reflecting a desire for more holistic living environments that blend indoor and outdoor comforts.

Planning Your Home Construction in 2024

Planning a home construction project in 2024 requires a detailed approach. Here are a few tips:

- Secure the Right Financing: With interest rates higher than we’ve been accustomed to, it is important to find the right lender and evaluate all programs available to you to ensure your new home is affordable.

- Choose the Right Contractor: Not all builders are equal. Choose a contractor with experience in modern construction practices and a track record of quality residential construction with a collaborative approach to home building.

- Budget with a Buffer: Given the unpredictability of material costs and labor, include a financial buffer in your budget to accommodate unforeseen expenses.

Why Choose Us for Your Building Needs?

Choosing the right partner for your home construction is more critical than ever. At Casper Builders, we pride ourselves on our expert knowledge, craftsmanship, and commitment to customer satisfaction. With years of experience in the industry, we understand the nuances of building in volatile economic times and are prepared to guide you through every step of your home building journey.

Building a home in 2024 is an exciting prospect that requires careful planning and the right partnerships. With the construction market constantly evolving and interest rates impacting budgeting decisions, being well-informed will be your greatest asset. If you’re considering building a new home, reach out to us at Casper Builders. Let us help you turn your dream home into a reality.

[1] thousand board feet

[2] OECD (2024), OECD Economic Outlook, Volume 2024 Issue 1: Preliminary version, OECD Publishing, Paris, https://doi.org/10.1787/69a0c310-en.